Stock Price Prediction Example Pipeline#

# Import necessary libraries

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

from sklearn.model_selection import train_test_split

from sklearn.linear_model import LinearRegression

from sklearn.metrics import mean_squared_error

# Load the data

data = pd.read_csv("MSFT.US.csv")

# Convert 'Date' column to datetime format

data['Date'] = pd.to_datetime(data['Date'])

# Display the first few rows of the data

print(data.head())

# Assume the column 'Close' is the target variable we want to predict

# We will create a feature 'Previous_Close' which is the 'Close' value of the previous day

data['Previous_Close'] = data['Close'].shift(1)

# Drop the first row since it will have a NaN value in 'Previous_Close'

data = data.dropna()

# Define the feature and target variable

X = data[['Previous_Close']]

y = data['Close']

dates = data['Date']

# Split the data into training and testing sets

X_train, X_test, y_train, y_test, dates_train, dates_test = train_test_split(X, y, dates, test_size=0.2, random_state=42, shuffle=False)

Date Open High Low Close Adjusted_close Volume

0 1986-03-13 25.4880 29.2608 25.4880 27.9936 0.0601 1031788800

1 1986-03-14 27.9936 29.4912 27.9936 29.0016 0.0623 308160000

2 1986-03-17 29.0016 29.7504 29.0016 29.4912 0.0633 133171200

3 1986-03-18 29.4912 29.7504 28.5120 28.7424 0.0617 67766400

4 1986-03-19 28.7424 29.0016 27.9936 28.2528 0.0606 47894400

# Create and train the linear regression model

model = LinearRegression()

model.fit(X_train, y_train)

# Make predictions

y_pred = model.predict(X_test)

print(y_pred)

# Calculate RMSE

rmse = np.sqrt(mean_squared_error(y_test, y_pred))

print(f"Root Mean Squared Error (RMSE): {rmse}")

[ 57.1998628 57.1201001 56.93066368 ... 423.44028091 422.77226828

426.78034407]

Root Mean Squared Error (RMSE): 3.8713363621627326

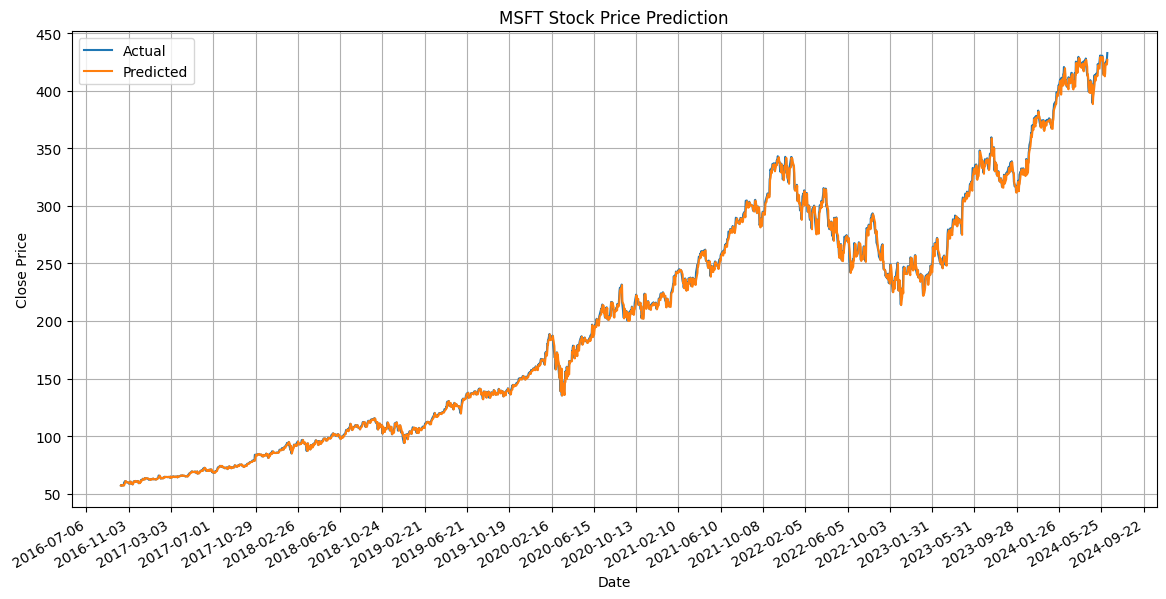

# Plot the results

plt.figure(figsize=(14, 7))

plt.plot(dates_test, y_test, label='Actual')

plt.plot(dates_test, y_pred, label='Predicted')

# Format the date on the x-axis

plt.gca().xaxis.set_major_locator(mdates.DayLocator(interval=120)) # Set major ticks every 10 days

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%Y-%m-%d'))

plt.gcf().autofmt_xdate() # Rotate date labels vertically

plt.xlabel('Date')

plt.ylabel('Close Price')

plt.title('MSFT Stock Price Prediction')

plt.legend()

plt.grid(True)

plt.show()